In our “Engineering Energizers” Q&A series, we highlight the engineering minds driving innovation across Salesforce. Today, we feature Madhura Kasinadhuni, Senior Director of Software Engineering. Madhura led her team in developing Digital Wallet, Salesforce’s first comprehensive consumption-based pricing visibility platform, which launched in July 2024. The platform now serves over 15,000 active organizations and has generated more than $400 million in annual contract value.

Discover how her team tackled foundational platform challenges as Data Cloud’s “customer zero,” integrated legacy financial systems with modern data infrastructure, architected failover strategies to maintain low latency in hourly usage tracking at enterprise scale, and built robust monitoring systems to ensure billing accuracy in mission-critical financial operations.

What is your team’s mission?

Our mission at Salesforce is to transform our consumption-based pricing model from reactive to proactive. As we expanded into products like Data Cloud and Agentforce, customers needed real-time visibility into usage patterns, the ability to track spending against entitlements, and tools to optimize their investments proactively. Account executives also required deeper insights to reach out proactively when customers approached contract limits.

To meet these needs, we created Digital Wallet, Salesforce’s first comprehensive consumption tracking and account management platform. It provides near real-time usage visibility for both customers and sellers, focusing on four key pillars:

- Transparency: Near real-time, granular usage insights across all products.

- Frictionless Self-Service: Customers can manage and scale entitlements independently.

- Proactive Support: Customizable alerts and usage forecasts help teams stay ahead of thresholds.

- Intelligence: Predictions and optimization tools guide spending decisions.

Our team is committed to eliminating friction in the consumption lifecycle and providing customers with the insights and tools needed for confident, data-driven decisions about their Salesforce investments.

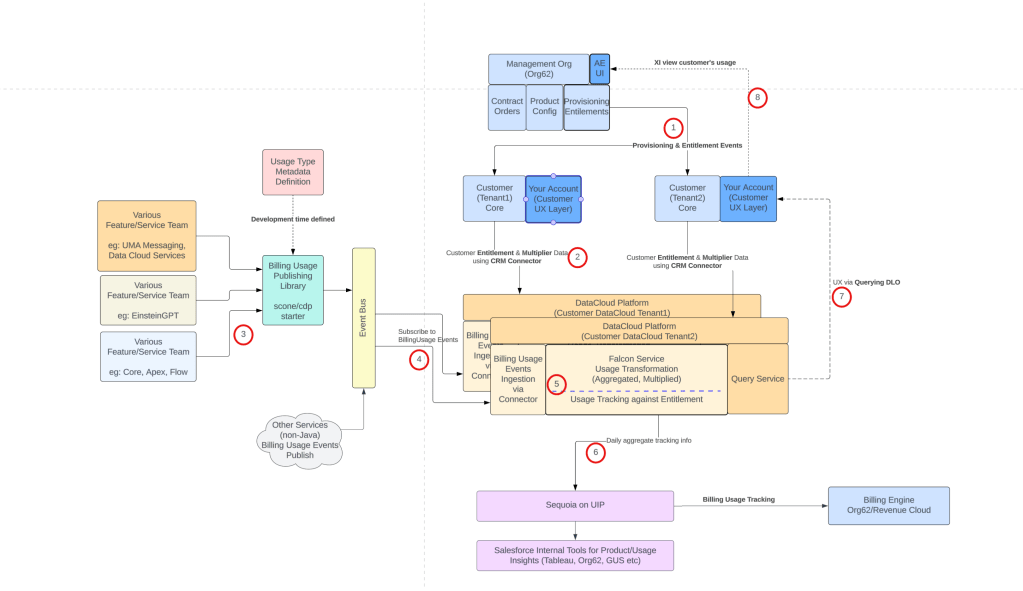

High-level Digital Wallet architecture.

What foundational technical challenges did your team overcome building on Data Cloud as “customer zero”?

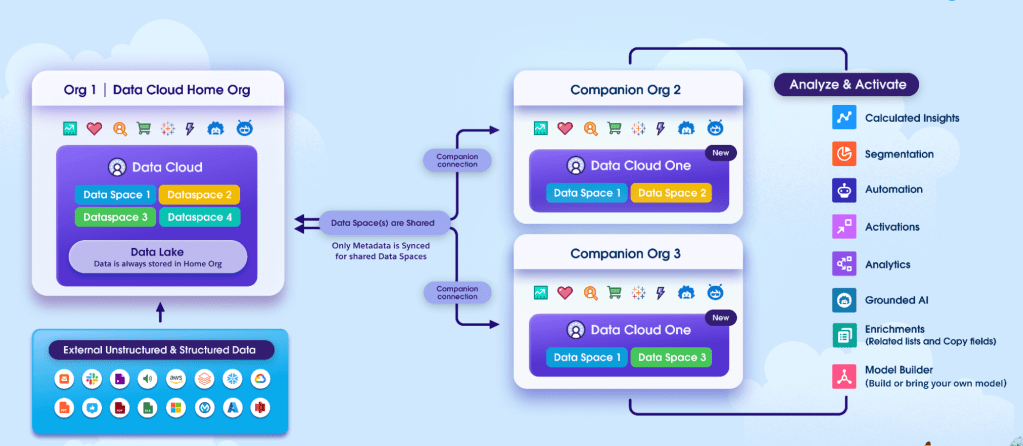

As one of the first teams building directly on Data Cloud, we faced unique obstacles that required us to develop foundational solutions for future platform builders. The biggest challenge was metadata security and SOX compliance. Data Cloud exposed our internal Digital Wallet metadata — data streams, connectors, and data lake objects — to customers with full CRUD control, raising SOX compliance concerns since customers could potentially compromise financial tracking.

To address this, we developed Strict System Mode, a secure enforcement layer that locks down metadata to prevent customer edits. This mode allows internal automation to function through an elevated system user with CRUD permissions, which are not available to customer users. The team extended Data Cloud’s permission framework, added API-level hooks, and implemented UI-level restrictions to ensure zero customer access while keeping systems operational.

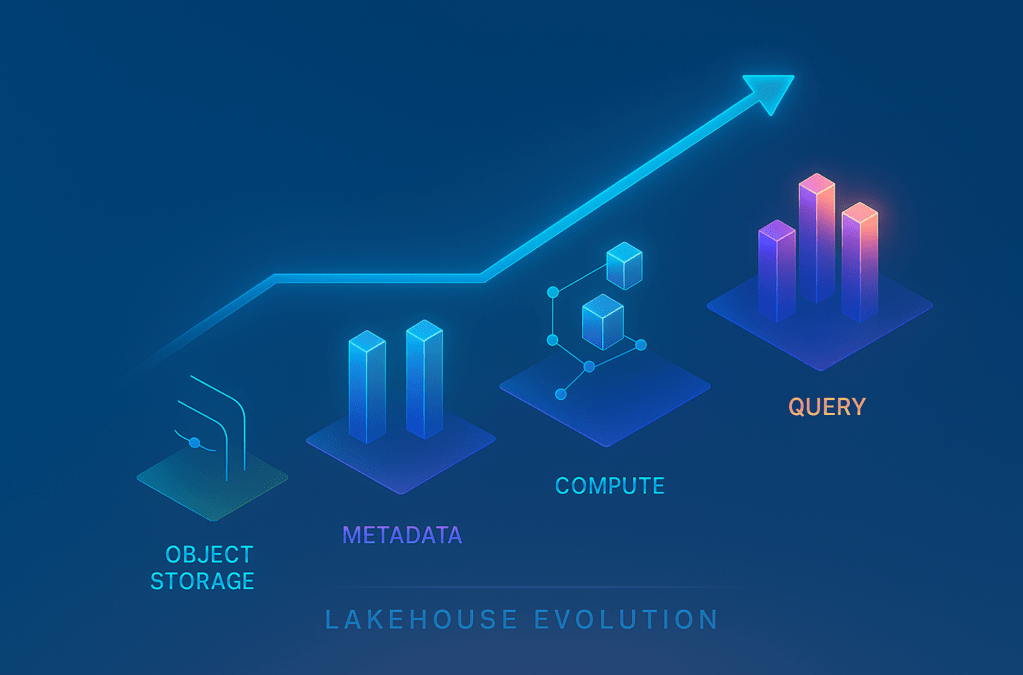

Beyond compliance, we also needed mission-critical ingestion capabilities. Our team engineered the Digital Wallet Subscriber, a custom extension to Data Cloud’s connector framework. This extension deserializes Platform Events and ingests them into the Data Cloud lakehouse for real-time usage tracking. The system leverages Salesforce’s Platform Events EventBus framework, where product teams publish structured usage events with metadata such as quantity, usage type, and org ID. Our connector acts as the single ingestion gateway, subscribing to these streams and processing 20 million events daily across all tenants.

What distributed systems challenges emerged integrating Digital Wallet across multiple Salesforce platforms for 15,000+ enterprise customers?

Connecting multiple systems for reliable consumption-based billing was challenging. Digital Wallet needed to integrate contractual financial systems, Data Cloud’s real-time usage pipelines, and Sequoia’s back-end billing platforms, ensuring accuracy, compliance, and high availability.

To sync contractual entitlements with each customer’s core org, we used a fan-out mechanism using standard Salesforce base platform objects. This entitlement info is then synced to its corresponding Data Cloud tenant via CRM connector’s hourly pull. This ensured every org had the correct financial baseline for usage monitoring. This copied entitlement data once and processed it locally, reducing latency and preventing availability issues during peak billing periods.

Additionally, enterprise customers deploy across production, sandbox, and companion orgs, but legacy systems couldn’t track consumption outside the home org. We integrated Digital Wallet into Data Cloud One, allowing our event subscriber to consume usage events across org boundaries. We also enhanced provisioning to install metadata in every companion org and extended our processing layer to aggregate usage across multiple orgs. Lastly, we developed a metadata-driven framework for customers to test, track, and optimize implementations in their sandbox instances from a single unified view.

Madhura shares what keeps her at Salesforce.

What scalability bottlenecks threatened real-time usage tracking at enterprise scale?

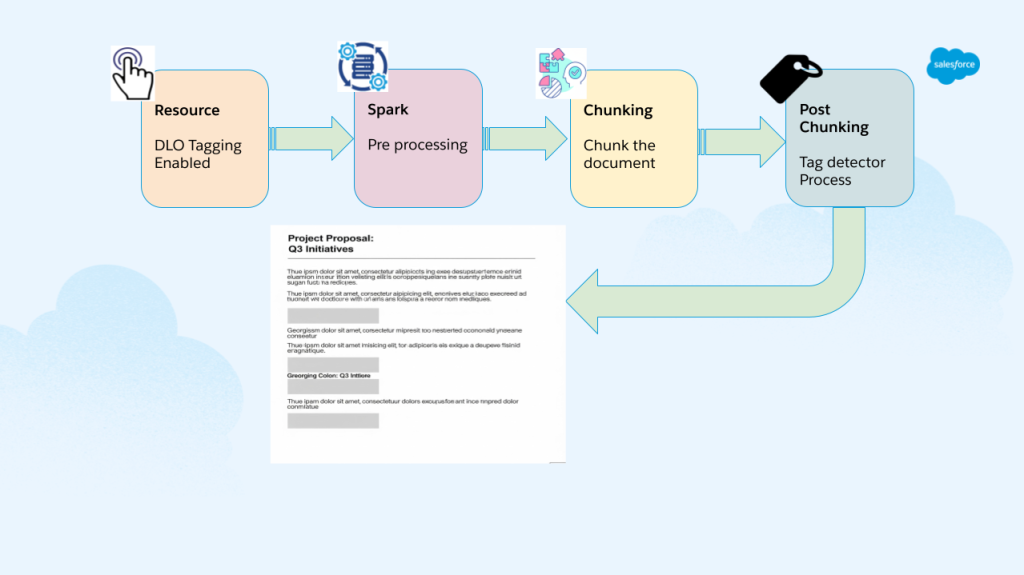

Delivering near real-time usage tracking at enterprise scale was tough due to infrastructure limits and strict billing accuracy requirements. When Digital Wallet moved to Data Cloud, the system faced heavy loads on the Customer Data Platform (CDP) Fabric, pushing it close to AWS rate limits and threatening reliability during the launch. The team worked with CDP Fabric to raise AWS limits and reduce the frequency of Spark jobs.

To avoid rate limiting issues, we set up a Spark job failover system that automatically shifts workloads from EMR-on-EKS to EMR-on-EC2, ensuring continuous processing. Digital Wallet runs three separate Spark jobs:

- Hourly Aggregation: Aggregates usage for a given tenant and applies contractual multipliers to convert usage to credits consumed.

- Daily Aggregation: Sends daily usage consumption data to Salesforce billing system in Org62.

- Enrichment Job: Processes usage attribution tags.

Each job operates independently to keep billing-critical calculations separate from evolving attribution features.

Architectural separation was key. Customers get hourly updates in the Digital Wallet UI, powered by Data Cloud, for near real-time insights into credit usage. Aggregated data is exported daily from Data Cloud to Sequoia on UIP, which then feeds into Salesforce billing. This setup ensures that monthly invoices meet the rigorous and auditable standards needed for enterprise finance while providing quick, customer-facing updates.

How does Digital Wallet maintain billing accuracy and trust as a financial-critical system?

Trust is our top priority. As we approached GA, we proactively built availability and monitoring into the system. The team reviewed all service dependencies, ran war room exercises to simulate disaster scenarios, and adopted high-cardinality monitoring per tenant through Monitoring Cloud. This allowed us to set up alerts based on individual tenant and service health.

The monitoring foundation guided our architectural decisions to protect billing integrity. We keep usage tracking and the billing layer strictly separate — Digital Wallet provides usage data, but billing is handled independently. Customers are billed monthly, while usage is tracked continuously, giving us a month to reconcile any discrepancies before billing. This buffer ensures accuracy and allows time to correct usage if needed.

We also implemented automatic retry logic with exponential backoff for transient failures, built cron jobs to detect and correct usage metadata and data and remote caching support to enhance resiliency. This ensures that every usage event is accurately recorded and reaches the financial system, even during partial outages.

Digital wallet adoption metrics.

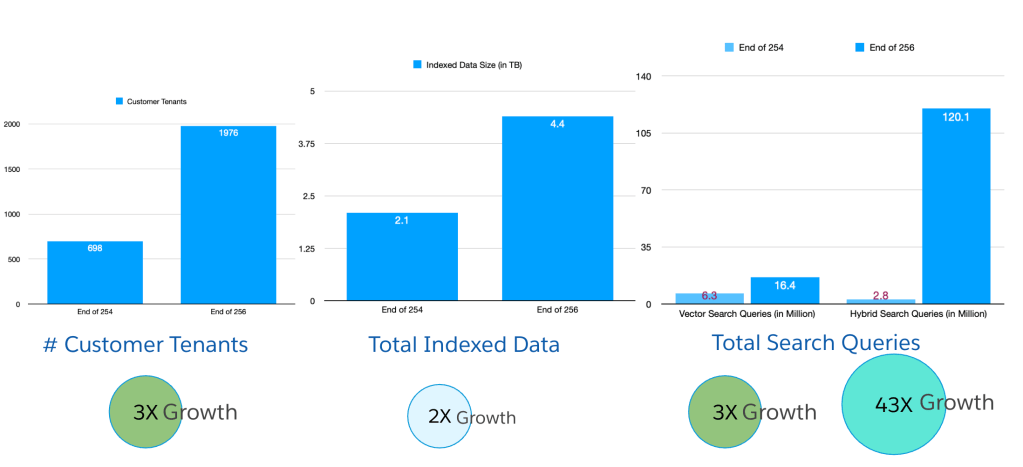

What measurable impact has Digital Wallet delivered since launch?

Within weeks and months of launching, we saw significant customer growth, demonstrating the platform’s value across the Salesforce ecosystem:

- Over 15,000 active organizations using Digital Wallet daily

- More than 13,000 active users, with around 580 daily active users

- Over 90% growth rate since Q1 of this year

- Over $400M in DSRs supported via through Digital Wallet

- Over 400 unique accounts on Flex Credit PayGo, launched less than two months ago

This adoption was heavily influenced by customer feedback:

- 33 voice-of-customer requests drove proactive alert features

- Over 50 requests shaped the usage tagging framework

- 18 requests informed our reporting capabilities

We built features based on what customers needed, not what we assumed they wanted. Account Executives use Digital Wallet to track customer usage and proactively reach out when customers hit limits or thresholds, enabling proactive sales conversations. The platform has fundamentally transformed how Salesforce delivers consumption-based pricing by providing the transparency, control, and intelligence needed to optimize Salesforce investments.

Learn more

- Stay connected — join our Talent Community!

- Check out our Technology and Product teams to learn how you can get involved.